Many people are embracing the convenience of online shopping, leading to a surge in ecommerce transactions. However, amidst this growth, there’s a hidden danger: the risk of fraud.

Scammers are always looking for weaknesses in your online store to exploit them. In fact, US ecommerce businesses are expected to lose a staggering $48 billion to payment fraud in 2024, according to Statista.

That’s why staying vigilant is no longer enough. You need to tap into the cutting-edge potential of Artificial Intelligence (AI) for ecommerce fraud detection and AI-Driven Customer Support.

In this article, let’s explore how AI can detect and prevent different types of ecommerce fraud and explore software solutions you can use to strengthen your business.

Table of Contents

I. What is ecommerce fraud?

Ecommerce fraud is any illegal activity that exploits online businesses and causes financial loss, damaged reputation, or customer distrust.

According to Statista, 62% of small and medium-sized businesses have reported an increase in ecommerce fraud attempts since the start of the pandemic.

Fraudsters use various tactics to carry out malicious activities, such as identity theft, stolen credit cards, account takeovers, and fake orders.

To tackle this growing problem, leveraging AI-powered fraud detection systems has emerged as a game-changer for ecommerce store owners.

Before we get into how you can use AI for ecommerce fraud detection, let’s first learn how scammers steal money from your customers and you.

II. What are the common types of eCommerce fraud?

Among the numerous online fraud tactics targeting ecommerce platforms, here are the top eight threats you need to be aware of:

2.1. Stolen credit card fraud

Credit card fraud is a common form of ecommerce fraud, often carried out by amateur fraudsters.

It involves acquiring and using stolen credit card information to make unauthorized purchases online.

The fraudster usually employs tactics like reshipping goods and masking their identity with techniques such as residential proxies.

2.2. Credit card testing fraud

Card testing is a popular tactic fraudsters use to verify the validity and spending limit of stolen credit cards.

They make low-value purchases to test if the card is still active and then proceed to make larger purchases.

2.3. Chargeback fraud

Chargeback fraud occurs when a scammer makes a purchase, receives the item, and then initiates a chargeback. It results in the online store owner paying for the transaction while the customer, who’s the scammer, gets a refund.

This type of fraud, also known as “friendly fraud,” can be challenging to detect as it often involves seemingly genuine claims.

2.4 Account Takeover Fraud (ATO)

Account takeover fraud is when a scammer gains unauthorized access to a customer’s account on an ecommerce store and exploits it to make fraudulent purchases.

Scammers commit this type of fraud using different methods, such as:

- Brute force attacks.

- Credential stuffing.

- Buying stolen credentials.

- Phishing schemes.

2.5. Return fraud

Return fraud is when individuals exploit a retailer’s return policy by sending back items not eligible for return.

These items can be stolen merchandise, used products, items from different retailers, or counterfeit goods.

2.6. Gift card fraud

Gift card fraud involves fraudsters purchasing gift cards using stolen payment information. They then either use these gift cards themselves or sell them to other unsuspecting individuals.

Some might even pose as government representatives to deceive customers into loading money onto their cards.

2.7. Triangulation fraud

Triangulation fraud is when a fraudster sets up a fake online store that lures customers with low prices on popular products.

The fraudster then steals the customer’s credit card information to buy the requested goods from a legitimate ecommerce store. Unfortunately, the customers end up paying the regular price and unknowingly have their credit card details stolen.

2.8. Interception fraud

Interception fraud occurs when fraudsters use stolen credit cards to place orders on your ecommerce store and intercept the package for themselves.

They use tricks like changing the shipping address with customer service, rerouting packages, or physically intercepting deliveries.

III. How AI detects eCommerce fraud

Now let’s explore how AI detects ecommerce fraud. You’ll discover two machine learning approaches that identify vulnerabilities in your online store and predict potential threats.

3.1. Detecting anomalies

AI detects ecommerce fraud by categorizing transactions into normal and potentially fraudulent based on their deviation from the expected patterns.

Various data variables, such as transaction details and images, are analyzed to assess the legitimacy of user actions and identify inconsistencies in the provided information.

Anomaly detection is a straightforward approach that offers binary answers, making it useful in certain situations.

For example, if the AI finds a transaction suspicious, it can notify you for further investigation or prompt the customer to undergo additional verification steps.

It typically relies on supervised machine learning, which involves training an algorithm with labeled historical data to predict target variables in future data.

3.2. Recognizing shopping patterns

Besides detecting obvious abnormal online behavior, AI fraud systems can also recognize emerging fraud patterns.

AI systems can adapt to new behavior patterns, such as changes in purchase categories during unique events like the pandemic.

For example, during the pandemic, individuals who had never previously engaged in home improvement or home fitness purchases were making unexpected transactions in these categories.

AI can help by adapting to these shifts in real time and preventing false declines.

This type of complex learning process requires an advanced fraud detection AI system called unsupervised machine learning.

Unsupervised machine learning involves analyzing unlabeled data to uncover hidden patterns and relationships.

This AI system not only autonomously discovers and classifies unknown patterns but also differentiates between the types of fraudulent activity.

IV. The pros of using AI for ecommerce fraud detection

As fraud becomes a bigger challenge in ecommerce, using AI for fraud detection offers significant benefits.

Here are some of them:

- Real-time detection: Advanced AI algorithms can process incoming data and quickly identify and block new threats within milliseconds.

- Reduces manual overview: AI reduces the need for manual review by automating the analysis of data points. This saves employees a lot of time that would otherwise be spent investigating threats and reviewing information.

- Improves with time: An advantage of employing AI for ecommerce fraud detection is its ability to improve over time through continuous learning from vast amounts of data.

- Quick and accurate verifications: AI systems enable the real-time processing of billions of transactions with absolute accuracy. These systems can compute risk scores within milliseconds.

- Saves time and money: Implementing AI for fraud detection reduces the need for manual screening. The accuracy of fraud detection outcomes becomes more precise and efficient as the system accumulates more data and experience.

V. The cons of using AI for ecommerce fraud detection

Although AI has the potential to revolutionize ecommerce fraud detection, you should be aware of potential challenges and limitations.

- False positives: While advanced AI systems aim to minimize false positives, it is challenging to eliminate them entirely. This could lead to blocking legitimate users, especially those using VPNs.

- Not for small businesses: Using AI for ecommerce fraud detection may not be suitable for small businesses due to the requirement of a large volume of data for accurate modeling. Moreover, AI software is expensive.

VI. Best AI fraud prevention software for ecommerce

Let’s explore top-rated AI fraud prevention software for ecommerce businesses based on aggregated ratings and reviews from reputable sources such as G2 and TrustRadius.

6.1. Signifyd

Signifyd is a leading fraud prevention product that offers end-to-end commerce protection. It was recently named one of the ten most innovative AI companies in the world by Fast Company.

Signifyd integrates with Magento, Shopify, BigCommerce, Salesforce Commerce Cloud, ReCharge, Inai, Primer, and Fraud.net.

Features:

- Guaranteed fraud protection.

- Account protection.

- Chargeback recovery.

- Return abuse prevention.

- Auth rate optimization.

- Order automation.

Pros:

- Precise detection of fraudulent orders.

- Clean and user-friendly interface.

- Perfect for enterprises seeking an effortless and automated solution.

Cons:

- No real-time data.

- Some orders are rejected without clear reasons provided.

- No social media lookup.

6.2. Kount

Kount is an AI-driven identity trust software that leverages its extensive global network and billions of trust and fraud signals to protect online stores and payment processors.

It integrates with Shopify, BigCommerce, Magento, Dodgeball, Salesforce Commerce Cloud, Shift4Shop, and Miva.

Features:

- Account fraud prevention.

- Account takeover prevention.

- Chargeback management.

- Authorization optimization.

- Various features to check a customer’s history.

- Global watchlist search.

Pros:

- Helpful customer service.

- Real-time monitoring.

- Easy to implement.

Cons:

- No social media lookup.

- Clunky user interface.

- Instances of flagging legitimate users.

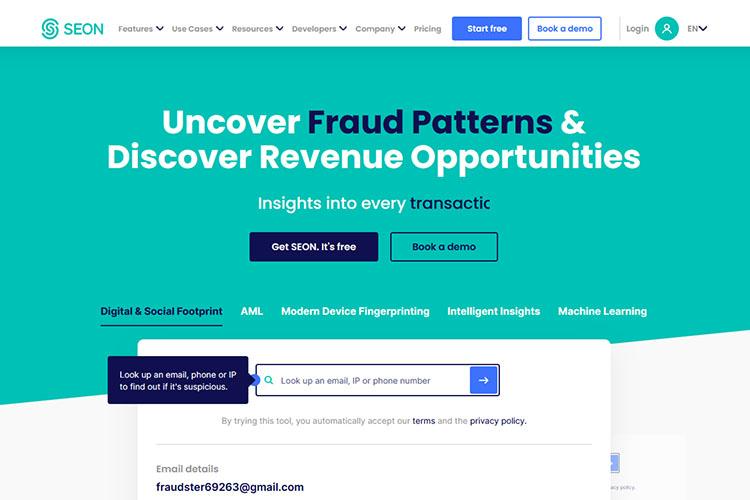

6.3. SEON

SEON is a comprehensive fraud detection platform that empowers ecommerce stores of all sizes to gain complete control over their accounts, interactions, orders, and transactions.

SEON offers seamless integration with Shopify through its dedicated app, and provides integrations with various third-party systems through its API. Plus, you can expand integration capabilities by connecting through Zapier.

Features:

- Email, IP, social media, and phone lookup.

- Device fingerprinting.

- Behavior analytics.

- Multi-accounting fraud detection.

- Real-time data.

Pros:

- Intuitive user interface.

- Easy to use.

- Comprehensive IP geolocation checks.

Cons:

- No chargeback guarantee.

- Competitive pricing.

- Long setup process.

Some of the best ecommerce fraud prevention tools that didn’t make it to the list but deserve recognition are as follows:

- Sift

- Arkose Labs

- Shield

- Riskified

- DataDome

- Cybersource

VII. How can you identify signs of ecommerce fraud?

To stay ahead of fraudsters, it’s crucial to be alert and proactive in identifying signs of ecommerce fraud.

When you recognize these red flags, you can effectively strengthen your defenses and protect your operations.

7.1. Unusual IP address locations

When a customer has a previous purchase history with your business, you should monitor them for any unusual activities originating from different than usual locations.

For instance, if the customer usually makes purchases from an IP address in the US but suddenly starts purchasing from China, that might indicate that the transaction could be fraudulent.

7.2. Higher than usual order volume

Fast, consecutive transactions or unusually high order volumes can indicate ecommerce fraud.

While it is possible for a genuine customer to make multiple back-to-back purchases, it most probably indicates fraudulent activity, such as card testing on your online store.

7.3. Multiple orders from many credit cards

Multiple orders from numerous credit cards of a single user account or consecutive back-to-back orders from different accounts with shared characteristics (e.g., same IP address) indicate potential cases of stolen credit card fraud or card testing fraud.

7.4. Repeated decline transactions

Honest customers may occasionally forget their PIN or exceed a card’s limit unknowingly.

However, it helps to be cautious if an account attempts over three to five unsuccessful transactions with incorrect credentials, including the card number, CVV, expiry date, and name.

7.5. Multiple shipping addresses

Multiple shipping addresses for orders placed using a single credit card may signal potential fraud. But it’s important to consider that the buyer could be a dropshipper.

Nevertheless, conducting dropshipping without a valid contract can be unethical and potentially illegal if your company prohibits this practice.

VIII. The future of AI in ecommerce fraud prevention

In the ever-evolving world of ecommerce, the importance of fraud detection and prevention cannot be overstated for both online sellers and consumers.

And as the battle against fraud intensifies, artificial intelligence emerges as the most viable solution to tackle this challenge head-on.

While fraud can never be wholly eliminated, AI empowers you with quick and accurate data processing at scale. Looking ahead, I believe AI will continue to play a pivotal role in fraud prevention.

In this article, I’ve covered different fraud detection tools to help you safeguard your online store, protect your customers, and outsmart those sneaky fraudsters.

Even if you’re not yet ready to implement AI, you now recognize the telltale signs of ecommerce fraud.

So why wait? Start fortifying your business today.

Author Bio

Niyotee Khedekar is a B2B ecommerce writer who loves writing about everything ecommerce, from the developments in Amazon, Magento, Shopify, and WordPress, to AI advancements and more. When she’s not writing, you can find her walking her dogs and playing chess.

![[SALE OFF] Discount 30% Off All Products On Christmas And New Year 2024 Christmas & New Year 2024 sale off from Landofcoder](https://landofcoder.b-cdn.net/wp-content/uploads/2023/12/xmas-banner-900-x-500-px-3-218x150.png)