Thank to the increase of eCommerce, payment solutions for marketplace businesses are more and more growing. Through traditional payment, mechanisms were inadequate for the job, marketplace payment alternatives arose.

In this article, we will explore factors about the marketplace payment solution:

- Which benefits vendors, customers and platform owners collects from online multi-seller payment options

- List a various rage of best online payment solutions

- Finnally, the best option for your business, as you are considering payment solutions for marketplaces

Table of Contents

I. The role of the payment solutions for marketplace owners

Nowadays, many platforms, such as Shopee, Tiki, and Esty, enable customers to use payment solutions for marketplaces. These are online payment methods exerting profound effects on eCommerce development. In particular, let us summary a list of benefits of marketplace payment solutions:

Firstly, it is simple to set up a merchant account by onboarding a new seller with the Online marketplace payment solutions. In other words, Accepting payments on any multi-vendors marketplace is applying for their own merchant account while customers are irritated by this conventional demand.

Also, while the transaction is in progress, take a portion of each transaction as a charge. Besides, Accept payments in every form feasible in the marketplace, although credit cards are the most common.

Next, once the money has been gathered and the marketplace has received its cut, payout to sellers through bank transfer. Meanwhile, the marketplace payment processing will provide marketplace vendors with reporting tools.

Many firms are attempting to gather similar items and form a marketplace. There are now platforms available that allow you to participate in this race without needing to build your own engine.

II. The main types of marketplace payment solutions

Online payment solutions for marketplaces are classified into single-vendor and multi-vendor platforms based on the number of merchants. The manners of eCommerce payment options are determined by the type of marketplace platform.

2.1. Single-vendors marketplace

All customers pay a single seller in a single-vendor marketplace. To receive money, a single-vendor marketplace owner simply has to give payment information.

2.2. Multi-vendors marketplace

The problem is more difficult in multi-vendor markets. To begin with, there is a slew of suppliers providing payment options for the marketplace with a slew of bank accounts. Moreover, marketplace owners must earn from their management of the marketplace. The final is that multi-vendor marketplaces enable buyers to purchase from several sellers at the same time. Allowing customers to pay for their whole cart at once, even if they’re buying from many merchants, will make their shopping experience more joyful.

In summary, eCommerce payment solutions, often known as payment solutions for marketplaces, allow you to manage payments in your multi-vendor marketplace with ease. The fundamental characteristics of a payment solution for a multi-vendor marketplace will be discussed in the next section.

III. Top 5 payment marketplace solutions for the eCommerce marketplace

3.1. PayPal

Paypal is one of the best payment solutions for marketplaces for purchasers to shop in many parts of the world. The language is English, so users can log in to their account settings simply. In specific, this marketplace payment solution is now available in Vietnamese.

If you want to know “Who accepts PayPal” or “Where can I use PayPal”, take a journey to some online stores accepting this solution payment. And we think you wouldn’t like to pass over how to use PayPal – Cash or Credit card.

Also, it’s now safer, easier, and faster for you to purchase and pay online at all of your favorite businesses thanks to PayPal. Despite the fact, there are some points which make buyers unsatisfied.

Cons:

- No Hidden Fees: Paying using PayPal is free; you’ll only be charged a fee if you sell anything or make a payment request.

- Free Return Shipping: Have you reconsidered your purchase? Return it for a reimbursement of up to US$20 on shipping costs.

- Earn Rewards: Depending on this payment solutions for marketplaces, we work with both domestic and international banks to ensure that you may use your chosen card(s) and continue to earn points.

- Always Protected: With Buyer Protection, 24/7 anti-fraud monitoring, and global stability, Shopping with PayPal is safer.

Pros

- Checkout page is outdated. Buyers are routed to the old-fashioned PayPal website after clicking the Pay with PayPal button, which is impossible to return from. This might be aggravating for many purchasers.

- The account has been frozen. PayPal might freeze your account without warning if it detects questionable activity on your account. On the one hand, this can provide further fraud protection. However, if PayPal’s analytics are inaccurate and your account is frozen for no apparent reason, it can negatively impact your company’s image.

3.2. Stripe

Stripe is a provider developing payment solutions for marketplaces. Connect can let you enroll, verify, and payout your freelancers, sellers, or other beneficiaries at scale, whether you run an on-demand, retail, or crowdfunding marketplace.

Cons:

- Onboard users instantly: Enable people to easily join up and be paid immediately. Use pre-built user interfaces to get up and running faster and increase conversions.

- Customize the experience: Customize the user experience by customizing onboarding choices, setting payout timing, collecting fees, and adding your own branding.

- Simplify compliance: Use out of Stripe’s global licensing. Shifting payments compliance to Stripe can help you save time and money on regulatory and compliance issues.

- Pay out globally: There’s no need to set up local businesses or banking partnerships to send money to people in more than 50 countries.

Pros:

- There is no such thing as a mass payment system. Marketplace buyers may make purchases from several merchants and pay for them all in one transaction via mass payments. A buyer just puts a purchase, pushes the Pay button, and waits for the goods to arrive with bulk payment. When bulk payments aren’t possible, purchasers must pay each seller individually, which might be inconvenient for marketplace users.

- A developer’s help is required. Despite the fact that Stripe’s documentation is well-written, Stripe cannot be implemented in your marketplace with a single click. You’ll need to employ a developer if you don’t have a technological experience.

3.3. Braintree

Braintree Marketplace gives scalable payments solutions for marketplaces. And it has a support system in all countries and regions. So Braintree has which benefits and limitations

Cons:

- Control and flexibility: We provide customisable APIs that you may use to build a powerful payment solution that matches your marketplace’s specific needs.

- The correct mix of payments: Braintree provides markets with a single connection that includes a variety of payment options such as cards, bank payments, PayPal, and popular wallets. As a member of the PayPal family, we provide you with the most well-known payment brands in the world.

- Activate outbound payments: We link markets to Hyperwallet, Braintree’s newest payment feature, so you can manage both sides of the transaction. Distribute cash to your platform’s worldwide merchants, freelancers, and contractors with ease.

Pros:

- Not as safe as the competition: Customers say that there are occasional security breaches, and that Braintree management does not always prevent fraudulent transactions.

- There is a lack of support: Although Braintree promises to provide help 24 hours a day, there are times when clients are unable to contact the company.

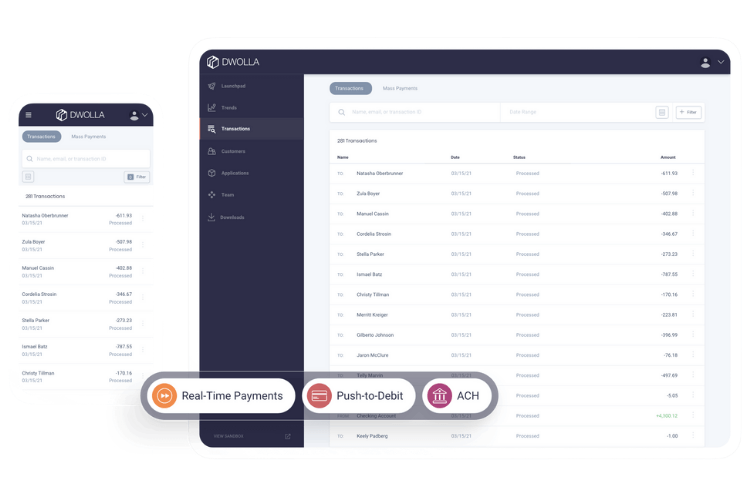

3.4. Dwolla

Dwolla is a modern payments platform using the best online payment solutions for marketplaces. Because of enabling innovators to program their payments with scalable and reliable technology.

Cons:

- Transfers through the Automated Clearing House (ACH): The Automated Clearing House is an American network that facilitates bank-to-bank transfers. One of the benefits of utilizing ACH is that unless you require an expedited transfer, it is free to use this method.

- Low Fees: Dwolla wants to earn a profit, thus it charges fees for acting as a middleman between your marketplace and American banks, even though ACH transactions are free. Nonetheless, the price is only 0.5 percent for both sending and receiving transactions, which is quite reasonable and considerably less than other payment platforms’ rates.

- Free trial: Dwolla is available for free trial to evaluate whether it fulfills your company needs.

Pros:

- Long wait periods for money transfers: Dwolla money transfers normally take one to two days. It’s a quirk of the ACH network, which is at the heart of Dwolla’s technology. So, if you pick this payment method, be in mind that transactions will take time. Dwolla, on the other hand, has a Same-day ACH option that your clients may utilize to expedite money transactions.

- The MoR is the owner of the marketplace: As we’ve already said, being a merchant of record entails a lot of administrative tasks. When you use Dwolla as your payment platform, you take responsibility for any financial transactions that occur on your marketplace.

- Only available in the United States: Dwolla is solely for American businesses, and overseas payments are not supported. This won’t be an issue if you get started right away.

3.5. Mangopay

Mangopay is also a large company providing payment solutions for marketplaces. It has advantages for businesses using it, but it brings some drawbacks.

Cons:

- Payments are simplified: Using a single contract, automate all money flows and commissions so you can focus on growing your business.

- Payment comes to you in your preferred method: With our seamless payment system, you may create your own payment flow that fits your business model.

- Maximum security with the least amount of worry: Several anti-fraud and money laundering protection solutions will keep your payments and transactions safe.

- Dashboard that may be accessed in real time: With our simple and easy-to-use dashboard, you can keep track of your transactions, commissions, users, e-wallets, and financial reports.

Pros:

- There is no free trial available: You are unable to determine whether this payment mechanism is appropriate for your marketplace.

- A small number of currencies are available: Mangopay only accepts 15 currencies, which might be a problem if you’re running a worldwide company.

IV. How to pick the best payment option for a marketplace

4.1. Target Markets’ Availability

The capacity to collect payments in the marketplace decides whether you can take payments in the market where you operate. It’s also crucial to think about a payment solution’s currency support. If you can process more currencies, you will have more business prospects.

4.2. Customer Service Quality

Payment service providers are key business partners with whom you can expect to communicate often. These communications must run without hiccups. Smaller PSPS are typically better at this. Small businesses cannot compete with larger enterprises in terms of feature sets. They must compensate by offering personalized assistance and focusing on a certain market area.

Furthermore, because everyone on the support staff is knowledgeable about the product, small businesses with a restricted feature set find it easier to provide high-quality customer service. When using the bulk payment option, you may pay for any orders with a single payment. The payment system automatically splits orders including items from several suppliers and distributes them among those sellers.

4.3. Tools for Tax Reporting

In marketplace payment processing, it might be quite beneficial to sellers in your marketplace. Payment providers may give tax reporting capabilities to merchants selling on your marketplace, but they aren’t usually included in their basic functionality.

4.4. The vision of payment solution of marketplace

A payment service provider may occasionally give you perks that go beyond functionality. Because their company strategy is identical to yours, they only benefit if your transaction volume is large. The proprietors of the company have a vested stake in your success.

4.5. Integration Ease

Building payment mechanisms for online markets is difficult. The speed with which a PSP can be connected with your business system may be more significant than the functionality it delivers, especially if you’re a small organization. Now that you know what qualities to look for in a payment gateway, you should start looking for the most popular solutions for your marketplace payment gateway.

4.6. Developing Trust in the Absence of Payments

If a corporation has no influence over the transaction, it cannot arbitrate. It is unable to block bad transactions, compel refunds, or withhold payments from vendors. Customers on Amazon Marketplace may buy with confidence, however, users must learn to be vigilant in order to avoid being cheated.

V. Consequent

Therefore, as using the payment solutions for marketplaces, it is quick to set up merchant accounts without gathering legal documentation. Besides, the platform provides each player get access to an add-on for monitoring and reporting, collecting third-party money, and conducting transfers with the marketplace payment solution.

Landofcoder, we have just brought overall multi-vendor payment solutions. You can give information about the best online payment solutions and the way to a process of payment solutions for marketplaces. How to choose the most suitable payment system for a multi-seller platform is of importance as it helps owners and vendors develop and optimize the workflow for payment and buying.

![[SALE OFF] Discount 30% All Premium Extensions On Christmas And New Year 2025 christmas-and-new-year-2025](https://landofcoder.b-cdn.net/wp-content/uploads/2024/12/christmas-and-new-year-2025-1-218x150.png)